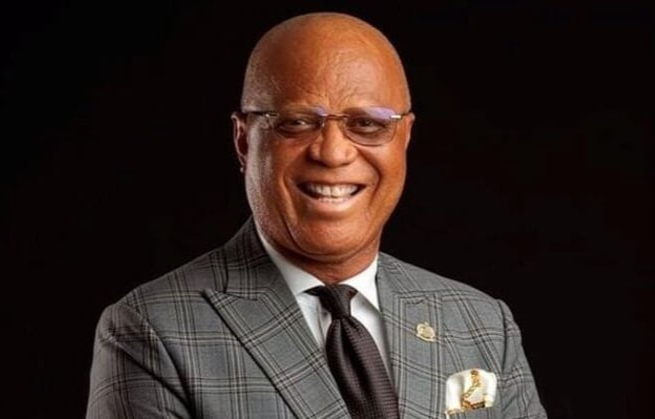

Pastor Umo Eno, Governor, Akwa Ibom State.(Credit:Google)

Abasifreke Effiong

Quietly, Governor Umo Eno, is paying up backlog of debts owed by the Akwa Ibom State Government. Some of the bills in foreign currencies date back to the 1993/94 short-lived civilian administration.

Akwa Ibom State Government obtained six foreign loans in 1994 from the African Development Bank to fund the First Multi-State Water Supply Project, according the external loan summary published in the 2019 annual report of the Accountant General of the State, sourced from the Debt Management Office (DMO).

The State’s domestic debt stood at ₦190.476bn, while external debt was $42.611 million USD as of December 31, 2023 according to the DMO.

In the first quarter of this year (Q1, 2024), Umo Eno’s administration paid off ₦14.920 billion in debt. This has reduced the state’s debt burden by 6.77%, if the foreign/external debts standing at $42.611 million USD are converted at the rate of ₦700/1USD, which is the 2024 budget exchange rate. Major currencies like dollar, euro and XDR (meaning, Special Drawing Right) which the foreign/external loans are denominated exchange at over a thousand Naira.

Details of the debt repayment published in the Q1 budget performance report, Office of the Accountant General, obtained The Dune Newspaper, show that ₦5.556bn was paid as arrears of pensions and gratuity. Repayment of internal bank loans ₦4.713bn, interest on internal bank loans ₦1.753bn, direct deductions from FAAC ₦1.650bn, contractual liabilities ₦293.5mn, and external/foreign loans ₦925.713mn.

Governor Eno is settling the liabilities in bits, but does not make a noise about it. The commitment shown in repayment of the loans is laudable. It will free the State from the appreciating value of the foreign/external loans keep rising exponentially due to forex. For instance, 1.00 XDR exchanged for N1,956.17 Kobo as of Sunday 19th May. XDR which means Special Drawing Right is the currency of the International Monetary Fund (IMF).

READ: How Akwa Ibom government is improving fiscal discipline

Akwa Ibom State debt profile was at its all-time high in 2022, prompting concerns from Civil Society Organisations (CSOs) working on fiscal governance reforms, and the Nigeria Union of Journalists (NUJ). Policy Alert, one of the front-lead CSOs working around fiscal justice in the Niger Delta, then said the state debt profile was near unsustainability. The “trend of loan acquisition in the State makes the debt profile of the State very close to unsustainability because these loans are not self-liquidating”, the organisation said in a press release in July 2021.

The press release did not give sufficient reasons for the organisation’s position.

However, the rising debt profile elicited broad concerns most especially at a time when production and price of crude oil in the international market dipped far below the budget benchmark. The outlook was scary because indicators for a possibly quick rebounds all pointed south. But then, the administration insisted the state debt was within sustainability threshold. Its position was on the basis of a debt-to-GDP framework, and perhaps the year-on-year growth in its internally generated revenue since 2017.

The CSO challenged the basis. In a release on July 14, 2022 , the organisation said using “debt-to-GDP ratio gives a false sense of fiscal sustainability”. Debt sustainability threshold prescribes borrowing limit that matches financial needs with the ability to repay now and in the future. The International Monetary Fund (IMF) debt sustainability framework (DSF) classifies debt-carrying capacity into three broad categories – strong, medium, and weak-,based on the following benchmarks: Present value of external debt in percentage of GDP and export, external debt service in percent of exports and revenue, present value of total public debt in percentage of GDP. Other composite indicators like historical (debt servicing) performance, outlook for real growth, remittances inflows, etc. Based on the IMF standard, the debt-to-GDP benchmark used as framework for calculating the State’s debt sustainable threshold in the 2023-2025 Medium Term Expenditure Framework (MTEF) was sound, valid and sustainable.

More so, the current voluntary repayment of debts by the Umo Eno administration is a composite indicator of economic viability. Akwa Ibom state is not under pressure currently from its creditors, and it is not paying the debts as condition to borrow more. Non-compulsive fulfilment of obligations to creditors shows fiscal responsiveness and integrity. It will brighten the fiscal outlook and enhances the credit worthiness of the State.

In a clime where politicians love personalised achievements, Governor Eno, had the liberty to ask for restructuring of the debts especially those owed commercial banks or defer the obligation to allow him channel fund to construct his own “signature” project. But he preferred to “connect the dots” from the past, atone for the efforts of his great great grand-fathers, great grand-father, grand-father and father, so that his children will have a less debt-yoked future. This is patriotism and statesmanship! He has shown good example. Government should be a continuum.

Governance is in full swing despite huge debt services. There is no dull moments. The Governor has not taken new loans. Recurrent revenue has improved. The administration has increased savings, while reducing overhead.

Two publicly known cost-cutting decisions stand out cleverly in Umo Eno’s one year in office. Retention of almost 100% of the previous state executive council and chairmen of statutory boards, and putting the State’s private jet to commercial use, were clever decisions. Retaining all commissioners and chairmen of statutory boards from the immediate past administration unintentionally turned out as a smart economic decision. Exco members and board chairmen who transitioned to the new administration maintain their official cars and office furniture. That has saved the State from spending on official cars, office furniture, and other perks for commissioners and chairmen of boards within the first year of this administration.

The administration will save ₦8billion budgeted for repairs and maintenance of the state private jet. The State spent ₦2.5 billion in 2019, and ₦3.281billion between January and September 2023 on repairs and maintenance of the jet.

Putting the state’s private jet to lucrative use was a drastic and patriotic cost-cutting measure by Exco. Commissioner for Information, Barr Ini Ememobong, quoted by BusinessDay said the cost reduction management structure for the jet was ‘predicated on the need for a drastic reduction in the cost of governance, the volatile exchange rate, and the corresponding increase in the cost of maintenance of the private jet. While the aircraft remains the State’s asset, it will be put to more lucrative use’.

Conversion of the private jet to commercial use was a noble act of selflessness, and a profound demonstration of deep devotion to the State by the Governor. Commissioner for Finance, Nsikan Nkan PhD., said “every one Naira has value to Governor Umo Eno”. Many one Naira can be saved for more value-added services by suspending State-sponsored pilgrimage, reorganising non-effective special purpose vehicles (SPVs) like the Akwa Ibom State Life Enhancement Agency, and Bureau of Technical Matters and Due Process; re-engineering local government councils through credible election to deliver sustainable development.