Mr Okon Okon, Executive Chairman, Akwa Ibom State Internal Revenue Service.

Abasifreke Effiong

The Akwa Ibom State Internal Revenue Service, AKIRS, says it is working diligently towards achieving full automation of all its revenue collection systems in 2023, and the possibility of having an electronic tax clearance certificate in the future.

Speaking at the season 2 of the inter-ministerial briefing, an interactive forum for government/citizens, tagged “tracking the promise”, organised by the Ministry of Information and Strategy, the Executive Chairman of AKIRS, Mr Okon Okon, said the agency is targeting greater efficiency and productivity with less human interference using technology.

Mr Okon said AKIRS recorded an impressive growth in IGR in 2022 fiscal year.

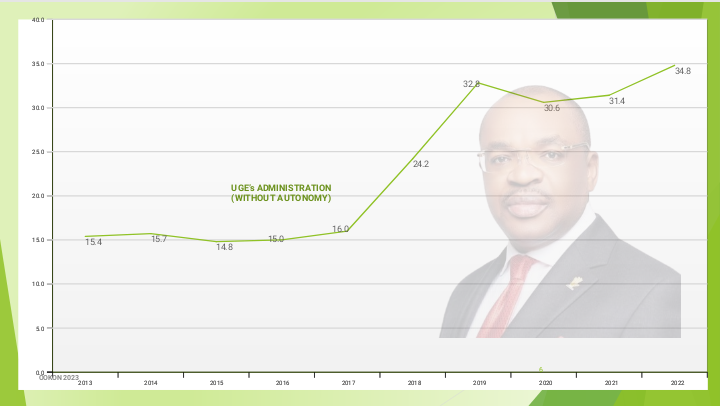

“We, again have recorded significant growth in our IGR collection. There has been a steady growth in IGR since 2017; in 2022, our IGR collection reached an all-time high of N34.8 billion”, he said.

The 2022 figure is N3.4 billion higher than the 2021 IGR collection which was N31.8 billion, representing an increase of 9.77 percent from the preceding year.

The state’s IGR staggered around N14.8 and N15.7 billion between 2013 and 2016, recorded its very first significant leap in 2018 with the collection of N24.2 billion. There has been a steady growth since then.

Giving highlights on what Governor Udom Emmanuel-led administration has done to improve revenue administration in the State, Okon said the steady growth in IGR from 2017 is attributable to the legal and institutional reforms in revenue administration, political will and prudent fiscal management by the Governor, the enterprise spirit in revenue administration introduced by the current Board of AKIRS and the pervading peace in the State.

According to him, “When our Governor, Mr Udom Emmanuel assumed office, he went to the House of Assembly in 2016 and obtained a Law, the Law is called Akwa Ibom State Revenue Administration Law 2016 (as amended). That set the autonomy of the revenue service for him to be able to run with.”

“Next to that was to set up the corporate governance. For the first time in the history of this State, Governor Emmanuel set up a full Board of Internal Revenue. Before then we used to have a department in the Ministry of Finance called Internal Revenue, that used to have a Chairman and Secretary as Board. Governor Emmanuel inaugurated a full Board which comprises the Chairman and 11 other members.”

“He (Governor Emmanuel) implemented political will by allowing the Board run and carry out its tasks according to the mandate given to them by the Law without any political interferences. What he also did that has made us achieve the feat we have recorded is to ensure that taxpayers’ money is put into quality use, where everyone can see; that has contributed to driving voluntary compliance.”

Polygon showing IGR trend in Akwa Ibom State from 2013 – 2022. (Credit: Akwa Ibom State Internal Revenue Service).

Polygon showing IGR trend in Akwa Ibom State from 2013 – 2022. (Credit: Akwa Ibom State Internal Revenue Service).

Okon, who is a Council member of the Joint Tax Board, JTB, and Fellow of the Chartered Institute of Taxation of Nigeria, CITN, said AKIRS Board under his chairmanship has institutionalized compact corporate governance practices that ensure inclusiveness, fairness, transparency, accountability, and probity in revenue administration in the State, and in turn strengthen taxpayers’ trust and confidence in the collection agency.

He disclosed that AKIRS is working towards full automation of its revenue collection systems in the 2023 fiscal year, saying that the agency has already automated road taxes and levies, upgraded its digital capabilities to allow taxpayers undertake online self-assessment through the AKIRS tax management system portal and for submission of annual tax returns online.

RELATED STORY: AKIRS commissions new ICT hardwares to enhance automation of revenue collection

“To ensure that all the effort of government yielded fruits, what we did as a Board was to introduce technology into our operations. We introduced automation. For instance now in Akwa Ibom state if you are doing vehicle licensing, you don’t need any human interference in that process. You can go to the bank or use an App to do your payment and when your document is ready, you go and collect it. On renewal, we have a system that will send you an alert from AKIRS notifying that your license is due for renewal.”

“In the same manner, we have introduced technology in direct online assessment, submission of tax returns.

If you log on to our TMS (tax management system) portal, we can download our assessment form and carry out self-assessment and thereafter the payment gateway will open to you, you can login, make your payment and print the receipt by yourself and bring it to us. Where we have not gotten to is the electronic tax clearance, we are working towards that.”

Responding to questions from a participant on the sustainability of the IGR growth without an increase in tax, Okon said, the Board is working to bring more people especially in the informal sector into the revenue net and was very optimistic that the incoming administration will continue where Governor Emmanuel stops in strengthening autonomy of AKIRS.

“We are currently organising the informal sector, it is a very complex sector, but we are leveraging on the group dynamics by bringing them together as groups and work through the groups. We are signing technology that can ease the administration of tax in that sector of the economy.”

“The underlying philosophy of the Udom Emmanuel administration is continuity and sustainability. It us our belief and conviction that the incoming administration will continue from where Governor Emmanuel stops in the implementation of autonomy for AKIRS and then if we have the opportunity to serve again we will also bring our mental resources and better experience to bear”, Okon added.